Browse through our Journals...

What every GP needs to know about financial risk in commissioning

Rodney P Jones PhD, (ACMA, CGMA)

Statistical Advisor

Healthcare Analysis & Forecasting

Abstract

The role of statistical and environment-induced volatility in admissions, attendances and costs is discussed in relation to managing financial risk and how Clinical Commissioning Groups can ensure that they are receiving competent advice and support. The majority of health conditions seem to exhibit relatively high volatility due to environmental sensitivity and this presents problems for forecasting, planning and financial management. Other conditions, especially of a medical or trauma nature, appear to follow long-term cycles. Some pragmatic first steps to negotiating these difficulties are the inclusion of confidence intervals on forecasts and a lead GP responsible for ensuring that managers are aware of these issues and take appropriate steps to prepare accurate forecasts along with a list of limiting assumptions. All forecasts should be subject to annual retrospective review to ensure that those preparing the forecasts are competent.

Key Messages for GP Commissioners:

-

The ever changing environment appears to play a greater role than has been appreciated in the exacerbation of poor health leading to high volatility in most health care costs

-

This volatility acts to obscure the exact trends and leads to uncertainty in financial forecasts

-

Long-term cyclic behaviour in health care costs appears to be more widespread than appreciated and these cycles themselves create the appearance of volatile behaviour

-

The management of financial risk is therefore more challenging than has been portrayed

-

All contracts should contain confidence intervals for activity and cost

-

CCGs need to understand the implied uncertainty and risk in activity and financial forecasts prepared on their behalf

-

GPs are advised not to assume personal financial risk for health care budgets

Areas for Further Research:

-

The role of location (local environment and its particular volatility) needs to be better understood

-

How many conditions show long-term cyclic behaviour

-

What is the optimum proportion of the total spend to be allocated to a national risk pool

-

Why is demography so poor at forecasting trends in demand and should trends in death and particular environmental factors be given greater weighting.

Contributors and Sources

Dr Rod Jones is a Chartered Management Accountant with over 20 years’ experience in forecasting health care demand, the statistical nature of health care costs and issues of capacity management. He has published over 100 articles and papers and attempts to communicate complex issues in a way that is easily understandable. He provides advice to healthcare organisations and has a regular ‘Money Matters’ series in the British Journal of Healthcare Management which investigates issues of efficiency and costs.

“Look before you leap”

A Provident Cliché: Think carefully about what you are about to do, or something you say to advise someone to think about possible problems before doing something.

Introduction

General practitioners (GPs), via their participation in local Clinical Commissioning Groups (CCG), are now ‘signed up’ to commissioning via the Health and Social Care Act (England) and it is therefore advisable to understand the financial risk implications of this responsibility. Over two years ago a short article highlighted the ambiguity surrounding financial risk in GP commissioning (1) and since then the debate has received scant attention, although everyone seems to acknowledge that it may be important and something needs to be done (2). Financial risk arises from four sources:

-

Uncertainty (volatility) in the level of costs which is related to size, location (local environment such as weather patterns, pollution or infectious outbreaks) and hidden long-term patterns in particular conditions arising from the link to the environment.

-

Uncertainty in costs due to the wider political and business environment such as changes in treatments and medications (NICE TAGs, e.g. Lucentis or supplier issues, e.g. Epanutin/Phenytoin), contractual risk, counting and coding issues at acute trusts, etc.

-

The available funds relative to the current (average) costs, given that this average is obscured by the volatility. This is further broken down into issues regarding the funding formula and the accuracy of financial forecasts.

-

Amplification of risk due to the Health Resource Group (HRG) tariff which is unique to those utilizing a fee-for-service tariff.

While the issues covered by point 2 above are important the bulk of discussion will be around the lesser recognised risks arising from the other points. Uncertain or volatile costs arise out of statistical variation around the average, which is largely a function of size, and additional volatility arising from the interaction between the environment (weather, air quality, other pollutants and infectious outbreaks) and human health, i.e. the contribution from location. To make the issues of volatility easier to understand the author has measured the year-to-year difference in activity and costs and calculated the average percentage difference over 10 to 20 year time frames (3). It is easy to understand that something with an average volatility of ±10% may be challenging from a financial risk perspective, i.e. on average costs next year will be around 10% different to this year. While an average of 10% may not preclude a 20% deviation in a minority of years it is a useful and easily understood concept and enables visualisation of what steps may be needed to manage such volatility. It also enables identification of conditions with the highest intrinsic volatility, i.e. sensitivity to the external environment. For example, it has been demonstrated that the top 110 diagnoses covering 72% of age 75+ admissions all show higher than 10% average volatility when adjusted to the equivalent at 1,000 admissions (4). The average volatility is related to the standard deviation, although the distribution around the average will be skewed (5).

Role of Size

Studies assessing the risk arising out of statistical variation are usually conducted via computer simulation or random sampling from patient cost data. These have been applied to financial risk in mental health costs (6,7). While these are useful in the evaluation of risk they only give the minimum case scenario since it is difficult to incorporate the effects of the environment into simulation or sampling. A review of this literature has concluded that (8):

-

Population groups greater than 100,000 are needed to keep this (minimum case) source of risk to an acceptable level

-

At a population of 100,000 the overall risk reaches its minimum level when inpatient events costing above £3,000 to £5,000 were transferred to a larger risk pool

-

Very large organisations can accumulate a considerable surplus/deficit simply due to random variation in case mix and activity, i.e. the lottery effect.

Specialised Commissioning covers some of the risk associated with rare and high cost conditions, however, it would be eminently sensible if this were expanded to a wider range of higher cost events (9,10) and thereby shift a higher proportion of ‘risky’ costs into what is a single national risk pool, funded via a top slice of NHS funds. This leaves GPs free to grapple with necessary cost saving schemes in the absence of distracting cost pressures arising from the more risky aspects of health costs. Such a scheme may then allow smaller CCGs in the range 100,000 to 300,000 head to be financially viable (see below).

Role of the Environment

That the environment must make a significant contribution to risk is evident from studies which show that the loss ratio, i.e. the ratio of claims paid out to premiums collected, in the US health insurance industry shows high volatility over long time periods even after adjusting for cost inflation and other factors (11,12). Indeed numerous studies show that human health is affected by a wide range of environmental factors with at least six journals devoted to environmental and biometeorology issues plus thousands of studies in other journals. There is a host of literature on the effects of weather, pollution, etc. Alas the majority are silo studies, i.e. only one condition is studied at a time. My own studies across multiple conditions appears to be picking up what looks like combined and interactive effects but as yet knowledge about what is interacting with what is lacking. For the elderly my suspicion is that the single condition approach is wrong. An excellent paper in Medical Hypotheses describes Mosaic ageing, i.e. weakest link breaks first (13). Hence whatever diagnosis happens to get recorded could be somewhat of a red herring.

In the ‘real world’ the contribution from the environment on outpatient referral, hospital admission, emergency department attendance, appears to be two- to three- times higher than from simple chance variation (5,14) and, in practice, far larger population groups, probably somewhere in the range 300,000 to 1,000,000 are needed to keep the combined risk to an acceptable level (15-18). Over an eight year period the average volatility in total costs was ±2% for the whole of England (3).

Studies on ‘real world’ volatility in health care costs show that the local expression of the (ever fluctuating) environment plays a far greater role than has been acknowledged. Every condition has a unique age- and gender-specific response to the combined and collective effects of all environmental parameters (19-21).

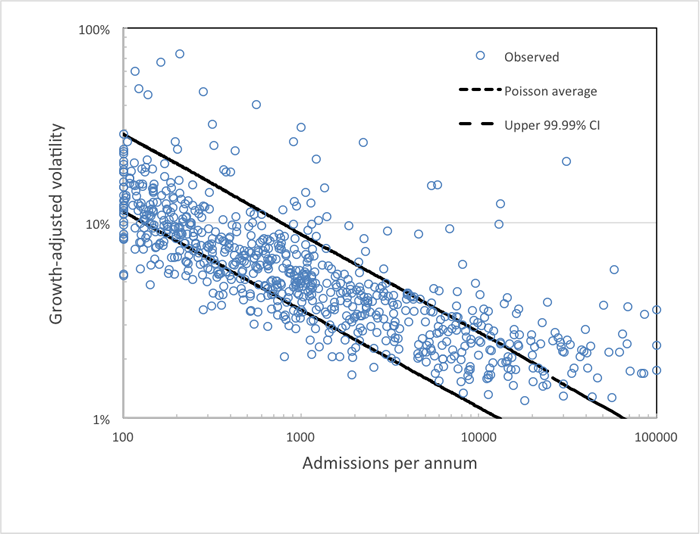

Figure 1: Average volatility associated with primary diagnoses in age 75+ admissions

Footnote: Data is from Hospital Episode statistics over the years 1998/99 to 2011/12 and covers all admissions (elective + non-elective) for each diagnosis. Growth-adjusted volatility as described previously (Jones 2012). The dotted line shows the upper 99.99% Confidence Interval (CI) for volatility from Poisson variation with 14 data points. Deviation from Poisson for groups with high admissions is probably to do with heterogeneity within the diagnosis. The role of the environment can be discerned in the unequal distribution around the Poisson average line.

Table 1: Top 15 volatile elderly diagnoses

ICD |

Description of primary diagnosis |

Episodes |

Raw |

Adjusted |

R69 |

Unknown and unspecified causes of morbidity |

31,120 |

139% |

116% |

N18 |

Chronic renal failure |

13,270 |

56% |

46% |

J22 |

Unspecified acute lower respiratory infection |

57,880 |

56% |

44% |

Z50 |

Care involving use of rehabilitation procedures |

2,250 |

61% |

39% |

Z03 |

Evaluation for suspected diseases |

5,840 |

43% |

38% |

Z73 |

Problems related to life-management difficulty |

5,400 |

55% |

36% |

J18 |

Pneumonia organism unspecified |

160,400 |

104% |

36% |

I12 |

Hypertensive renal disease |

12,930 |

61% |

35% |

Z00 |

General examination |

210 |

36% |

34% |

J44 |

Other chronic obstructive pulmonary disease |

85,630 |

43% |

31% |

Z04 |

Examination and observation for other reasons |

1,000 |

38% |

31% |

H25 |

Senile cataract |

68,880 |

53% |

31% |

F99 |

Mental disorder not otherwise specified |

560 |

36% |

30% |

Z51 |

Other medical care |

160 |

32% |

27% |

H35 |

Other retinal disorders |

50,200 |

95% |

27% |

Z74 |

Problems related to care-provider dependency |

280 |

35% |

25% |

R68 |

Other general symptoms and signs |

910 |

25% |

25% |

R26 |

Abnormalities of gait and mobility |

6,830 |

29% |

24% |

H26 |

Other cataract |

132,320 |

59% |

23% |

N03 |

Chronic nephritic syndrome |

1,210 |

28% |

23% |

Footnote: Adapted from (Jones 2013). Volatility is for total admissions (elective + emergency). With permission from British Journal of Healthcare Management. Raw = volatility not adjusted for growth, Adjusted = with adjustment for growth. Episodes are the average between 2009/10 and 2011/12.

Figure 1 illustrates many of the above issues and shows the average growth-adjusted volatility for age 75+ hospital admissions in England assessed for the 755 diagnoses with highest admissions. Note that the average volatility increases as size decreases which is the contribution from size, i.e. the same mathematics that drives sample size selection in randomised trials. Also note the spread in volatility across diagnoses with the same number of admissions. This spread arises from statistical scatter due to an average from just 14 years of data and also the intrinsic environmental sensitivity of each diagnosis. The dotted line gives the upper 99.99% Confidence Interval (CI) for volatility arising from Poisson variation, i.e. the maximum extent of statistical chance-based volatility.

Hence for diagnoses having between 950 to 1,050 admissions (at 1,000 admissions the maximum extent of statistical chance is 7.83%) the least environmentally sensitive is the condition described by the International Classification of Diseases (ICD) code M35 (other systemic involvement of connective tissue) at 3% volatility through to 14% volatility for H61 (other disorders of the external ear) or Z04 (examination and observation for other reasons). The latter may reflect admissions to avoid breaching the four hour target, i.e. surge admission volatility interacting with hospital capacity issues. Hence if there were 100 equally sized CCGs in England, the local volatility will rise as national volumes are divided by 100, i.e. local volatility will be roughly 10-times higher and hence 2% national volatility has now risen to 20% local volatility, etc. The exact volatility at the 100 locations will depend on both the timing and extent of the mix of weather, pollution and infectious outbreaks actually experienced. Indeed particular locations are known to have unique weather patterns (45).

To determine if volatility is restricted to long term conditions Table 1 gives the top 15 elderly diagnoses showing the highest intrinsic volatility. Two measures of intrinsic volatility are given, namely, an ‘as is’ calculation which ignores any effects of underlying growth and an adjusted value which corrects for underlying growth. Table 1 has some clear messages about renal disease with three primary diagnoses in the top 15, namely, N03 (chronic nephritic syndrome), N18 (chronic renal failure) and I12 (hypertensive renal disease); three eye diagnoses; three diagnoses which are signs and symptoms; three respiratory conditions (of which one is COPD) and seven diagnoses from Chapter Z of which three are for examination and may reflect overspill from A&E (the four hour target) during times of winter pressure, and four are clearly to do with rehabilitation and the interface with social/primary care. A broad brush summary would probably be unstable health toward the end of life, which remains the same despite health care setting.

A logical extension of the role of the environment is the existence of long term cycles. The authors first experience of such long term cycles was at the Royal Berkshire hospital (Reading, Berkshire) when the Orthopaedic trauma bed pool suddenly and unexpectedly filled with patients. Analysis of a time series revealed that this was part of a long term series of cycles. The data was analysed by a Fourier Transform (software which looks for hidden patterns in noise or vibration) which revealed that such patterns were responsible for the seemingly inexplicable behaviour (5). Additional patterns covering other aspects of health care have been subsequently documented (22-32). The whole area is poorly studied and largely ignored since it would appear it is easier to blame organisations for financial failure than to admit that it is the policy framework which is at variance with the ‘inconvenience’ of reality.

The ‘real world’ consequence is that it is far more difficult to achieve a balanced budget in some locations than others. While the English funding formula is very sophisticated and adjusts local funding to differences in age, gender, deprivation and other factors it assumes that the difficulty (due to intrinsic volatility) of matching costs to the available funds is not related to location. It is highly likely that omission of the role of the environment from the funding formula leads to funding imbalances (32).

Implications

Since most CCGs are managed as a series of different sized localities the role of size on the volatility associated with the local budgets should not be neglected and implies locality specific confidence intervals. In some CCGs budgets are managed at practice level and if this is the case then stop-loss risk sharing for any person costing more than £5,000 is a priority. As the size of the organisation reduces the point at which stop-loss kicks in also reduces. In the USA a level of $100,000 stop-loss was found to be adequate for most state-wide insurance exchanges to remain stable (7) – by way of comparison the combined population of the states of California and Texas is greater than that of England. GP’s should therefore insist that all budgets contain appropriate confidence intervals and should also be aware that most financial variances (usually given as percentage variance), while financially significant are not generally statistically significant. Herein lies the central dilemma within commissioning, namely, that in a research context GPs are taught that if something is “not statistically significant” they cannot reliably infer anything from the study; yet they are asked to respond to almost every adverse financial variance in spite of the fact that the majority arise due to the natural volatility (including cycles) in health care activity and costs. The health service has never been encouraged to have a mature discussion about this dilemma since it is one of a range of intrinsic factors contributing to what is an unavoidable post code lottery.

The next issue is with the adequacy of financial forecasting. In my experience it is a sad reality that the bulk of activity and financial forecasts are ‘massaged’ to match costs with funding. This is driven by the expectation that no NHS organisation will ever go into deficit and is backed by a rather heavy handed performance management regime. Organisations obviously do go into deficit and this largely arises out of the self-imposed blindness flowing from attempting to run with a massaged budget. After a twenty year career in health care forecasting the author has concluded that demographic-based forecasting creates illusionary budgets since long-term cyclic behaviour is far more widespread than hitherto realised. Additional long term changes in morbidity and mortality also act to create non-linear trends and invalidate the fundamental basis for demographic forecasting (33). As mentioned the cycles arise out of the interaction between the environment and health and can be seen in GP referral, A&E attendance, ambulance journeys, emergency admissions, and certain types of elective activity (23-32). The author has estimated that a particular medical cycle adds around £6 billion into the cost of the NHS in England and is the principle cause of the cycle of surplus and deficit which has become explicit since the introduction of the purchaser provider split and guaranteed waiting times (22-29). Such a cycle implies that surpluses should be retained to be reinvested in the years when costs are higher, i.e. at certain times activity may appear to slow or even reduce. As stated, the whole area is poorly understood and attracts almost zero funding for the basic research needed to understand these issues especially as they relate to financial forecasting and management.

It is far better to know the likely real cost of future aspects of the health care budget than to deny their existence. Hence all financial plans should be retrospectively audited for accuracy as part of a process which ensures that the CCG is receiving competent support. GP’s need to insist that all plans are based on analysis of a long-term data series that is not limited to simplistic linear regression fits or demographic extrapolations to the data. This must go back to 2006 (at a minimum) since 2007 was the point of initiation of a major cycle in medical emergency admissions, GP referral and A&E attendance. All budgets should therefore include the likely forecast for next year (with confidence intervals) plus the anticipated impact of cost reduction initiatives (with estimated confidence intervals) which then gives the audit trail for sound financial management. Do not get fobbed off by weak arguments around data availability and quality. Some of the arguments around data quality arise from a misunderstanding of the long-term cycles and the residual part arising from local counting and coding issues (33) needs to be flagged as part of sound financial forecasting and risk evaluation. CCGs need to be far more vocal regarding issues of counting and coding which the DH has avoided addressing for many years.

The HRG Tariff

The final issue is the amplification of purchaser risk arising from the application of the HRG tariff within a Payment by Results (PbR) framework. While the majority of provider costs are fixed the tariff assumes they are variable. In a world where activity was increasing in a straight line manner over time this would not be a problem but in a world exhibiting cycles for a large proportion of costs the tariff becomes a tool which magnifies the risk to the purchaser, i.e. every fluctuation in activity is magnified by the direct application of a cost per case tariff. This becomes even more relevant if the three year lag in calculating the tariff is out of phase with the major cycle governing medical admissions (22,26). Efforts by the DH to promote ‘efficiency’ such as shifting 10% of follow-up costs into the price of a first appointment likewise act to magnify financial risk in view of the long term cycle in GP referrals – a cycle which appears to mirror the medical admissions cycle (30). Net volatility is further enhanced by considerable year-to-year volatility in the price assigned to each HRG which largely arises from abysmally poor costing in most hospitals (35-36). It is pleasing to note that Monitor has taken rapid steps to address these issues.

The tariff also contains a series of major limitations which are never discussed (36-37) and in particular the mismatch between the assumptions in the capitation funding formula around the effect of age and how age is used within the tariff creates a set of financial imbalances depending on the age structure of the population, i.e. populations which are younger than average create a cost pressure for the purchaser but not for the provider and vice versa (38). Could this shed some light on why London seems to cost more than it is ‘supposed to’? The author has also suggested that areas of higher population density are likely to have higher costs and that high outward migration from London for those who reach retirement age, i.e. those who are healthy and wealthy, leaves this city enriched in a remaining elderly population which will be ‘sicker’ than average (39). Far more mutual risk sharing is required. The 30% marginal cost tariff for emergency admissions introduced in 2010/11 is a fairly crude example of such a risk sharing vehicle (40). Moves toward year-of-care tariffs and personal healthcare budgets may go some way toward sharing and dampening the risks for costs associated with long term conditions.

There is however, a more subtle twist to the issue of cost savings. Unless the move to community care leads to a lower total staff cost across the whole of the NHS then the supposed ‘savings’ are merely artefacts of the HRG tariff. A CCG counts a £3,000 saving by avoiding an admission but the real saving is (say) £300 in the cost of tests conducted at the hospital since the rest of the ‘costs’ are fixed. If the CCG has spent more than £300 to make the so-called cost saving then the underlying reality is that total costs have increased. In this respect note that those admissions relating to care where the patient dies in hospital tend to cost less than a similar admission where the patient is discharged alive. The tariff charges the average cost for both. The cost per case in the HRG tariff will likewise increase as lower acuity cases are kept in the community and assumed cost savings from length of stay reduction are generally overstated due to a logarithmic decline in the cost per day over time (46). There will be a three year lag in such cost shifts as another artefact of the processing time between the collection of reference costs and the calculated tariff costs. To reiterate, the purchaser/provider split is an artificial construct and the tariff contains seriously flawed assumptions which only work in a steady-state world. Cost savings reported at locations where large shifts have already occurred are therefore being overstated. There has been a serious lack of thought around these issues.

Transfer of Volatility

While the transfer of patients out of the acute sector is desirable and will eventually deliver real savings at a national level there is a poorly appreciated transfer of volatility and loss of economy of scale (4,41). Currently large numbers of patients are treated at large acute facilities which gains both economy of scale and reduces volatility as per the effect of size in Figure 1. As patients are transferred to the community this has profound implications to the community work force and how the enhanced volatility in demand is managed at small scale (42) and to issues of clinical risk (43). Hence while national costs are reduced in aggregate the situation will be more fluid at local level. In the private sector such a transfer of risk would normally be compensated for by a higher profit margin. The central role of volatility in resource utilisation (13) has not been thought through and has profound implications to volatile demand against fixed social care resources within fixed practice and local authority boundaries.

Conclusions

Given that funding for the Health Service will decline in real terms over the coming years the role of cost saving becomes more pressing. Firstly, to halt the natural rise in activity and costs and secondly to bring average costs to a point below available funding. This gap is the necessary response to the natural volatility associated with average costs and the need to maintain a surplus in readiness for those years when the natural cycles for particular (groups of) conditions elevate costs above the level of available funding.

The risk associated with health care budgets is far higher than will be publically acknowledged by the DH or the government and GPs need to look before they leap into next year’s budget forecasts prepared on their behalf. An appropriate response to this article may be that CCGs appoint a GP with an interest in statistics to oversee this area and to ensure that CCG and CSU managers become familiar with the fundamental research and to initiate appropriate changes, such as confidence intervals on the activity and costs within budgets. These are merely the necessary first steps to instilling wider awareness to the appropriate management of financial risk in GP commissioning. GPs need to co-ordinate their efforts via their professional bodies to insist that the NHS Commissioning Board applies policy in a rational and evidence-based manner rather than resorting to ‘manage by targets’ pseudo-management which seeks to ignore the underlying issues in favour of an “it’s all your fault” approach (44).

It would seem that the ultimate intention is that private companies run the Commissioning Support Units (CSU) (see EU procurement notice http://ted.europa.eu/udl?uri=TED:NOTICE:163853-2013:TEXT:EN:HTML&src=0) and this opens up the possibility that GPs will fall victim to financial exploitation via manipulation of financial forecasts. For this very reason the author advocates a not-for-profit co-operative model for CSU ownership. It is therefore vital that GPs and CCG Boards combine their collective understanding of statistical principles (inherent volatility and variation, regression to the mean, effects of sample size, etc) with their clinical knowledge, experience and intuition. They must understand the nature and limitations of data and its interpretation to avoid being manipulated into the latest ‘bold initiative’ or ‘quick-fix’ scheme by managers under pressure to demonstrate (real or imagined) cost savings to the NHS Commissioning Board and its agents. Indeed any attempts to get GPs to personally assume responsibility for CCG debts should be resisted on the basis that health care costs are not behaving according to the previously held simplistic notions and at worst may be responding to the external environment in a manner beyond the control of GPs (or indeed any other alternative commissioner).

Conflict of Interest

The author provides consultancy to health care organisations.

Acknowledgements

Comments and suggestions from M Auchterlonie, C Buckley, D Cosgrove, C Gerada and D Paynton are gratefully acknowledged.

References

- Jones R. What is the financial risk in GP Commissioning? British Journal of General Practice 2010; 60(578): 700-701.

- Bardsley M. Risk sharing and risk pooling. Nuffield Trust, London 2012. http://www.nuffieldtrust.org.uk/sites/files/nuffield/martin_bardsley_risk_sharing_and_risk_pooling_290212.pdf

- Jones R. Why is the ‘real world’ financial risk in commissioning so high? British Journal of Healthcare Management 2012; 18(4): 216-217.

- Jones R. Financial risk and volatile elderly diagnoses. British Journal of Healthcare Management 2012; 19(2): xx-yy.

- Jones R. Financial risk in health care provision and contracts. Proceedings of the 2004 Crystal Ball User Conference, 2004 http://www.hcaf.biz/Financial%20Risk/CBUC_FR.pdf

- Asthana S, Gibson A, Hewson P, et al. General practitioner commissioning consortia and budgetary risk: evidence from modelling of 'fair share' practice budgets for mental health. J Health Serv Res Policy 2011; 16(2): 95-101

- Barry C, Weiner J, Lemke K, et al. Risk adjustment in health insurance exchanges for individuals with mental illness. Am J Psychiatry 2012; 169(7): 704-709.

- Jones R. The actuarial basis for financial risk in practice-based commissioning and implications to managing budgets. Primary Health Care Research & Development 2009; 10(3): 245-253.

- Jones R. High risk categories and risk pooling in healthcare costs. British Journal of Healthcare Management 2012; 18(8): 430-435.

- Jones R. Financial risk in health purchasing Risk pools. British Journal of Healthcare Management 2008; 14(6): 240-245.

- Born P, Santerre R. Unravelling the health insurance underwriting cycle. California State University; 2005. http://www.business.uconn.edu/healthcare/files/working-papers/Unraveling%20the%20Health%20Insurance%20Underwriting%20Cycle.pdf (accessed 2 February 2013)

- Jones R. Risk in GP commissioning: the loss ratio. British Journal of Healthcare Management 2012; 18(11): 605-606.

- Walker L, Herndon J. Mosaic aging. Medical Hypotheses 2010; 74(6):1048-1051.

- Jones R. Financial and operational risk in health care provision and commissioning. Healthcare Analysis and Forecasting, Camberley 2002. www.hcaf.biz/Financial%20Risk/Variation_healthcare.pdf (accessed 28 January 2013)

- Jones R. Volatile inpatient costs and implications to CCG financial stability. British Journal of Healthcare Management 2012; 18(5): 251-258.

- Jones R. Cancer care and volatility in commissioning. British Journal of Healthcare Management 2012; 18(6): 315-324.

- Jones R. End of life care and volatility in costs. British Journal of Healthcare Management 2012; 18(7): 374-381.

- Jones R. Financial risk in GP commissioning: lessons from Medicare. British Journal of Healthcare Management 2012; 18(12): 656-657.

- Jones R. Gender and financial risk in commissioning. British Journal of Healthcare Management 2012; 18(6): 336-337.

- Jones R. Age and financial risk in healthcare costs. British Journal of Healthcare Management 2012; 18(7): 388-389.

- Jones R. Year-to-year volatility in medical admissions. British Journal of Healthcare Management 2012; 18(8): 448-449.

- Jones R. Nature of health care costs and financial risk in commissioning. British Journal of Healthcare Management 2010; 16(9): 424-430.

- Jones R. Trends in programme budget expenditure. British Journal of Healthcare Management 2010; 16(11): 518-526.

- Jones R. Cycles in inpatient waiting time. British Journal of Healthcare Management 2011; 17(2): 80-81.

- Jones R. Volatility in bed occupancy for emergency admissions. British Journal of Healthcare Management 2011; 17(9): 424-430.

- Jones R. Time to re-evaluate financial risk in GP commissioning. British Journal of Healthcare Management 2012; 18(1): 39-48.

- Jones R. Are there cycles in outpatient costs. British Journal of Healthcare Management 2012; 18(5): 276-277.

- Jones R. Increasing GP referrals: collective jump or infectious push? British Journal of Healthcare Management 2012; 18(9): 487-495.

- Jones R. Age-related changes in A&E attendance. British Journal of Healthcare Management 2012; 18(9): 502-503.

- Jones R. GP referral to dermatology: which conditions? British Journal of Healthcare Management 2102; 18(11): 594-596.

- Jones R. Trends in outpatient follow-up rates, England 1987/88 to 2010/11. British Journal of Healthcare Management 2012; 18(12): 647-655.

- Jones R. A fundamental flaw in person-based funding. British Journal of Healthcare Management 2013; 19(1): 32-38.

- Nicholl J. Case-mix adjustment in non-randomised observational evaluations: the constant risk fallacy. J Epidemiol Community Health 2007; 61: 1010-1013.

- Jones R. Equilibrium: A report on the balance between providers and commissioners on the use of NHS Data Standards in ‘admitted’ patient care. Healthcare Analysis & Forecasting, Camberley, 2007. http://www.hcaf.biz/Recent/Data_definitions_short.pdf (accessed 2 February 2013)

- Jones R. Limitations of the HRG tariff: the national average. British Journal of Healthcare Management 2011; 17(11): 556-557.

- Jones R. Limitations of the HRG tariff: gross errors. British Journal of Healthcare Management 2011; 17(12): 608-609

- Jones R. Is the Health Resource Group (HRG) tariff fit for purpose? British Journal of Healthcare Management 2012; 18(1): 52-53.

- Jones R. Limitations of the HRG tariff: local adjustments. British Journal of Healthcare Management 2009; 15(3): 144-147

- Jones R. Population density and healthcare costs. British Journal of Healthcare Management 19(1): 44-45

- Jones R (2010) Emergency preparedness. British Journal of Healthcare Management 2010; 16 (2): 94-95.

- Jones R. A guide to maternity costs - why smaller units cost more. British Journal of Midwifery 2013; 21(1): 54-59

- Jones R. The effect of randomness on health visitor workload. Healthcare Analysis & Forecasting, Camberley, 2001. http://www.hcaf.biz/Financial%20Risk/Health_Visitor_Workload.pdf (accessed 2 February 2013)

- Smith P, Mackintosh M, Ross F, et al. Financial and clinical risk in health care reform: a view from below. J Health Serv Res Policy 2012; 17 (Suppl 2): 11-17.

- Jones R. Response to: ‘Incentives for GPs to cut emergency admissions could lead to ‘target culture’, warns GP leader’. BMJ 2013; 346: f312 www.bmj.com/content/346/bmj.f312/rr/625652 (accessed 29 January 2013)

- Baldi M, Salinger J, Dirks K, McGregor G (2009) Winter hospital admissions and weather types in the Auckland region. Australian Government Bureau of Metrology. http://www.bom.gov.au/events/9ichsmo/manuscripts/M1415_Baldi.pdf

- Ishak K, Stolar M, Hu M-y, Alvarez P, Wang Y, Getsios D and Williams G. 2012: Accounting for the relationship between per diem cost and LOS when estimating hospitalization costs. BMC Health Services Research 12, 439.

Copyright Priory Lodge Education Limited, 2013 onwards.

First Published June 2013

Click

on these links to visit our Journals:

Psychiatry

On-Line

Dentistry On-Line | Vet

On-Line | Chest Medicine

On-Line

GP

On-Line | Pharmacy

On-Line | Anaesthesia

On-Line | Medicine

On-Line

Family Medical

Practice On-Line

Home • Journals • Search • Rules for Authors • Submit a Paper • Sponsor us

All pages in this site copyright ©Priory Lodge Education Ltd 1994-